Back

27 Sep 2022

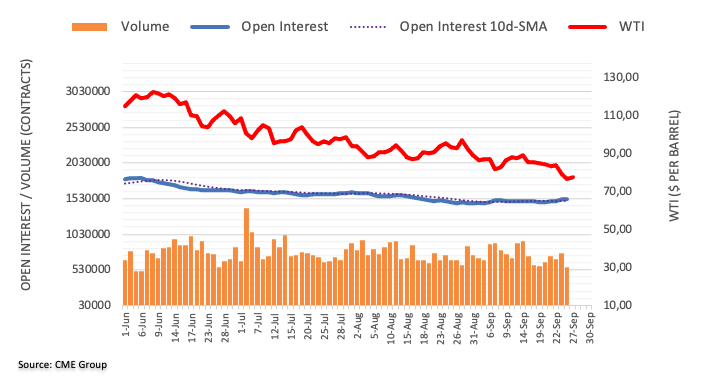

Crude Oil Futures: Potential bounce in the offing

Considering preliminary readings from CME Group for crude oil futures markets, traders trimmed their open interest positions by nearly 3K contracts following four daily builds in a row at the beginning of the week. In the same line, volume dropped the most since September 15, this time by more than 186K contracts.

WTI: Next on the upside comes $80.00

Prices of the WTI retreated to the vicinity of the $76.00 mark on Monday against the backdrop of shrinking open interest and volume. That said, further decline seems unlikely for the time being and the door now looks open to a probable rebound with the immediate hurdle at the $80.00 mark per barrel.