EUR/USD Price Analysis: Bears lurking at daily resistance

- EUR/USD has shot up to test a critical daily resistance area.

- DXY below a critical level of support, now turned resistance.

The Euro has been outperforming as the greenback crumbles to below critical areas of support on the daily charts.

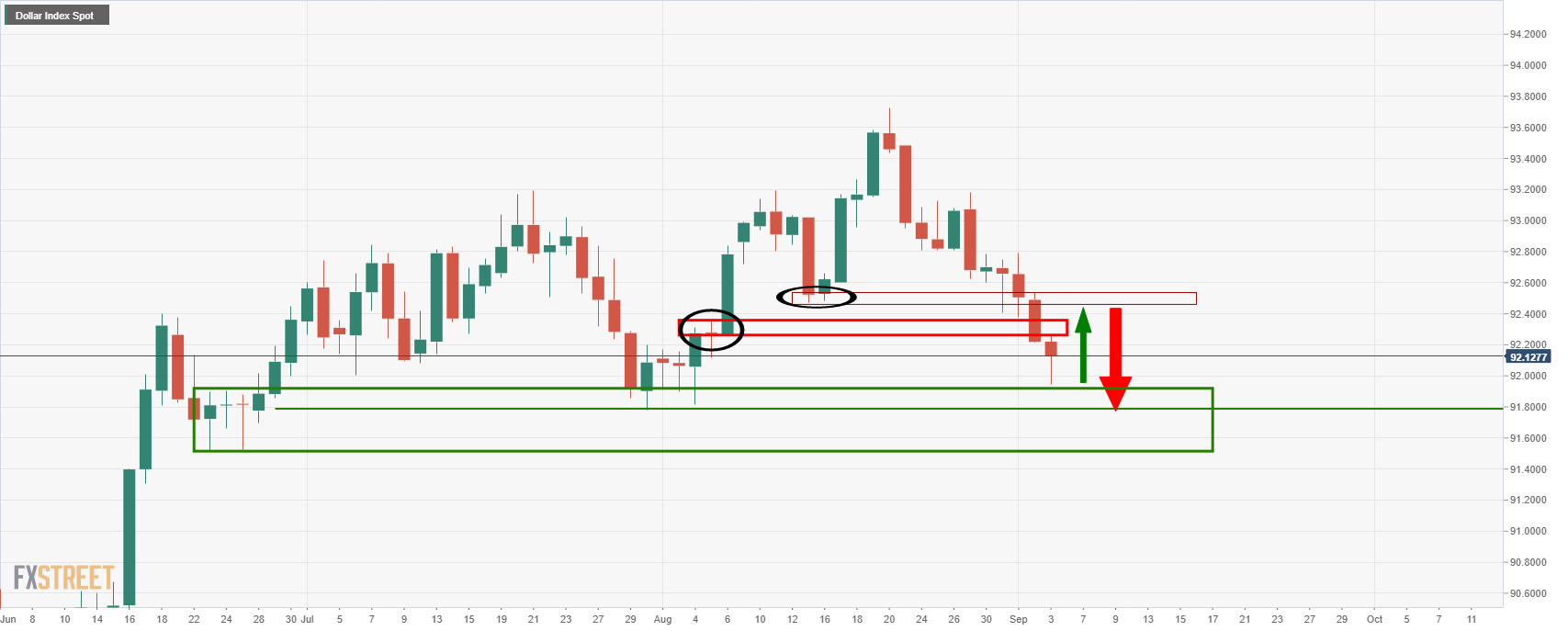

DXY daily chart

As illustrated, the price broke the 13 Aug low as well as the 5 Aug structure which exposes 91.80 and lower for a deeper test of demand territory for the days or weeks ahead.

The following illustrates, however, a corrective scenario in the euro from daily resistance.

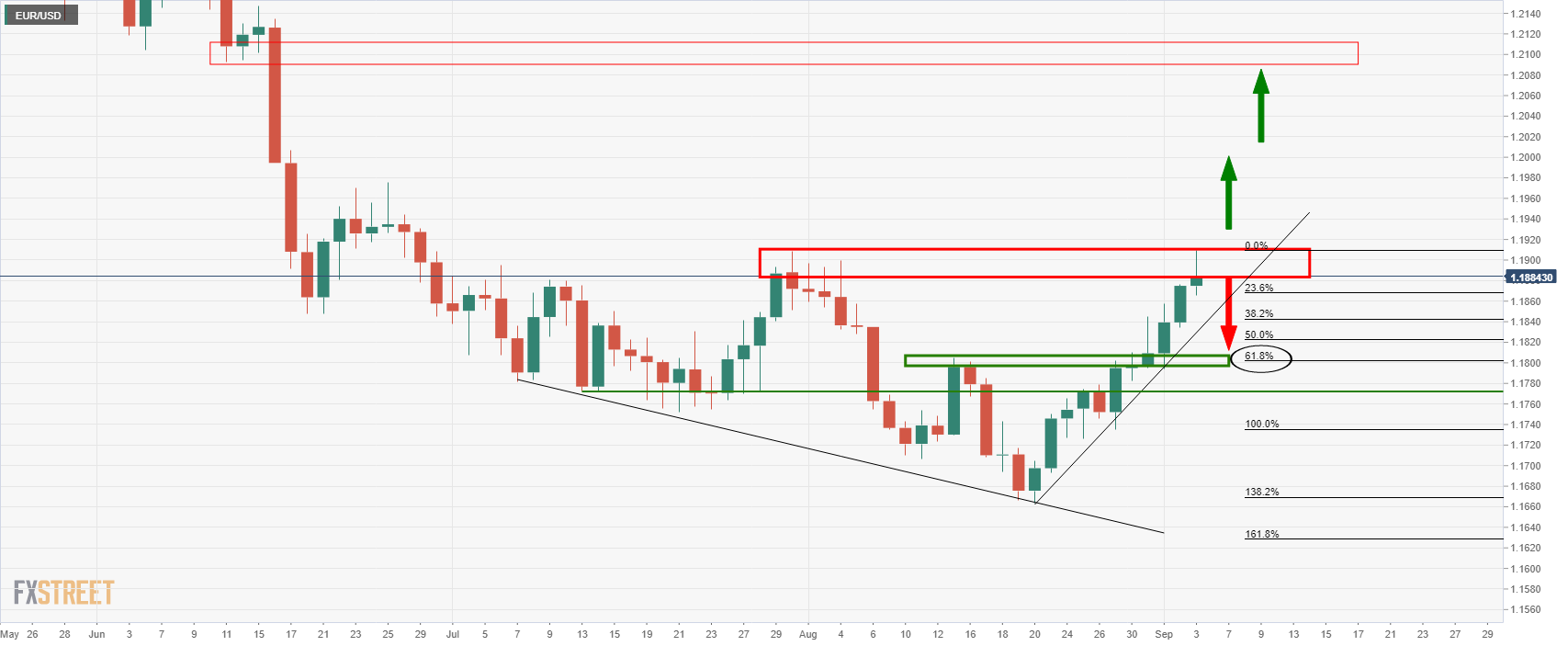

Daily chart

The price is meeting resistance in the 1.1880/00s which puts a focus on the downside for a meanwhile correction.

The prior level of resistance, near 1.18 the figure, could be targeted on a restest.

This also aligns with the 61.8% Fibonacci retracement level.

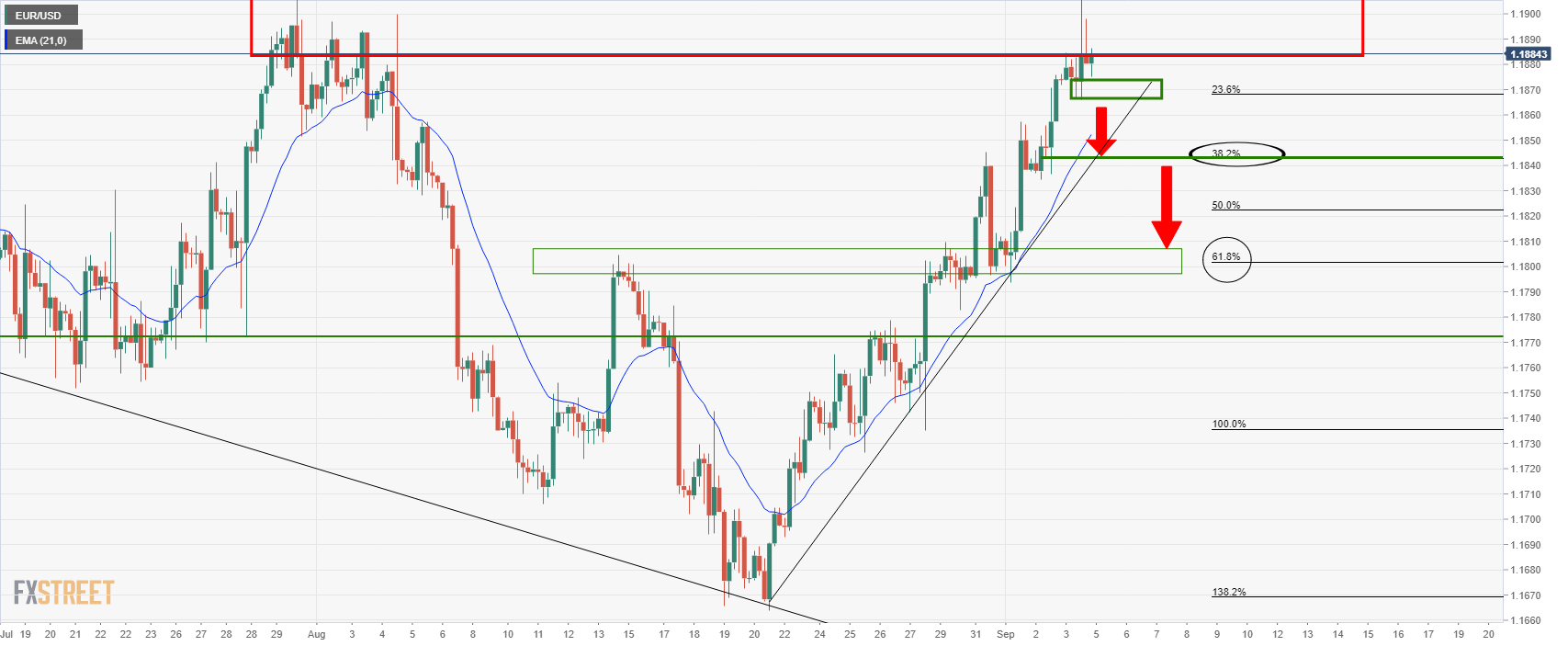

4-hour chart

On the lower time frames, there are a number of structures for the bear to contend with first.

The first area of support comes in as the daily 38.2% Fibonacci retracement near 1.1845 which has a confluence with the 21-EMA.

A break there opens the prospects of a test of the dynamic daily support and a subsequent follow-through opens the path to the 61.8% target.