Back

14 Jun 2021

Crude Oil Futures: Correction on the cards

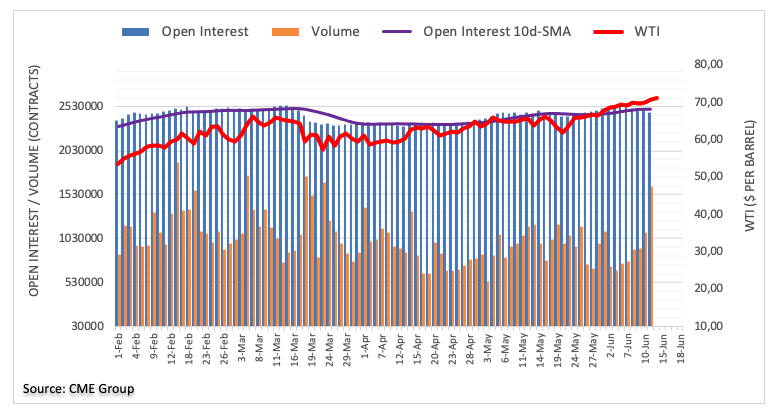

In light of flash data for crude oil futures markets from CME Group, open interest extended the downtrend for yet another session on Friday, this time by around 21.2K contracts. On the other hand, volume rose for the sixth consecutive session, now by around 522.1K contracts, the largest single-day build since March 23.

WTI: Overbought levels could prompt some correction

WTI prices extended the rally on Friday and clinched fresh tops, all amidst declining open interest. This, plus the current overbought conditions of the commodity (as per the daily RSI) could spark some near-term corrective downside. The broader outlook, however, remains tilted to the positive side for the time being.