AUD/USD Price Analysis: Bulls step in front of a freight train

- AUD/USD bears send the price into daily support.

- A significant correction to the upside would be expected at this juncture.

- Medium-term, the bias is firmly with the bears.

As per the prior analysis, AUD/USD bears are lurking at daily resistance, the price has been rejected there and subsequently dropped like a stone.

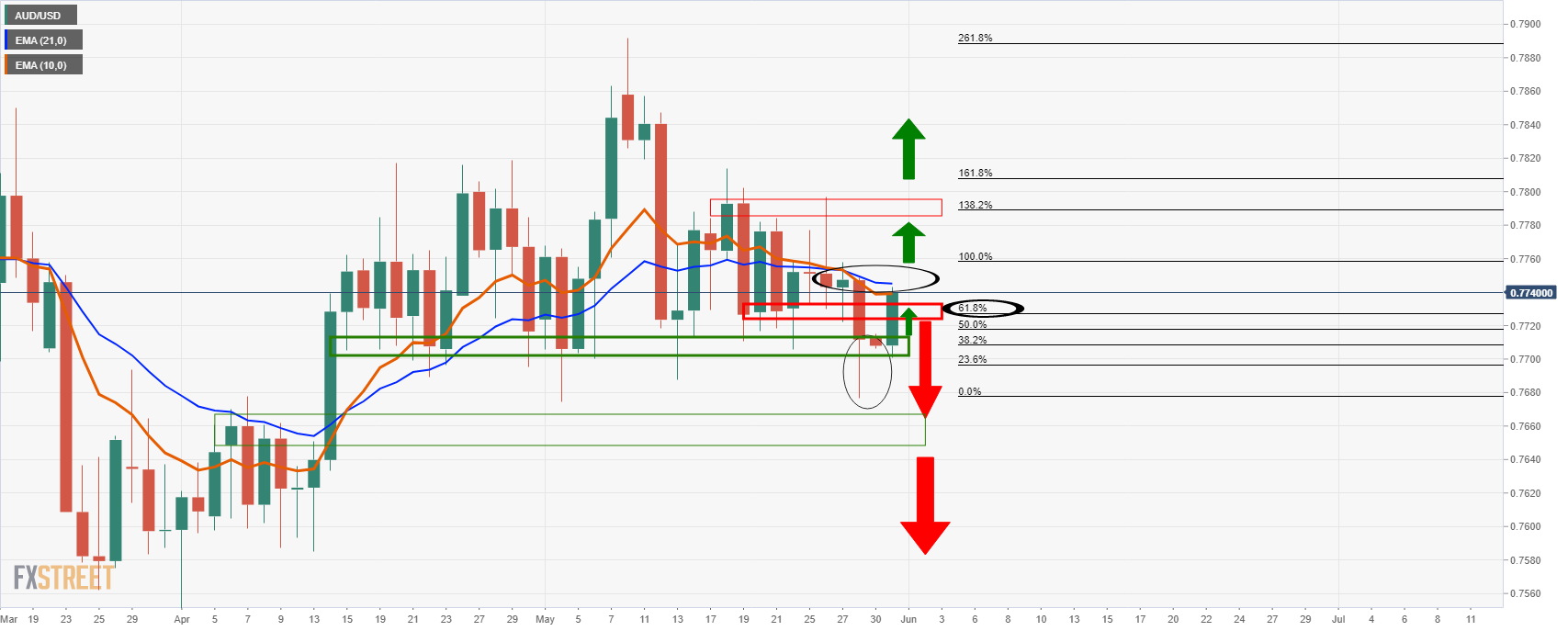

AUD/USD Prior analysis, daily chart

''We have seen a firmer test of the M-formation's resistance as follows:''

''The price has even surpassed the 61.8% Fibonacci but has so far tested the 78.6% Fibonacci resistance and the confluence with the 27 May high liquidity candle, which too would be expected to act as resistance.

Consequently, there are downside risks and the potential of a fresh daily bearish impulse to crack the current daily support structure.''

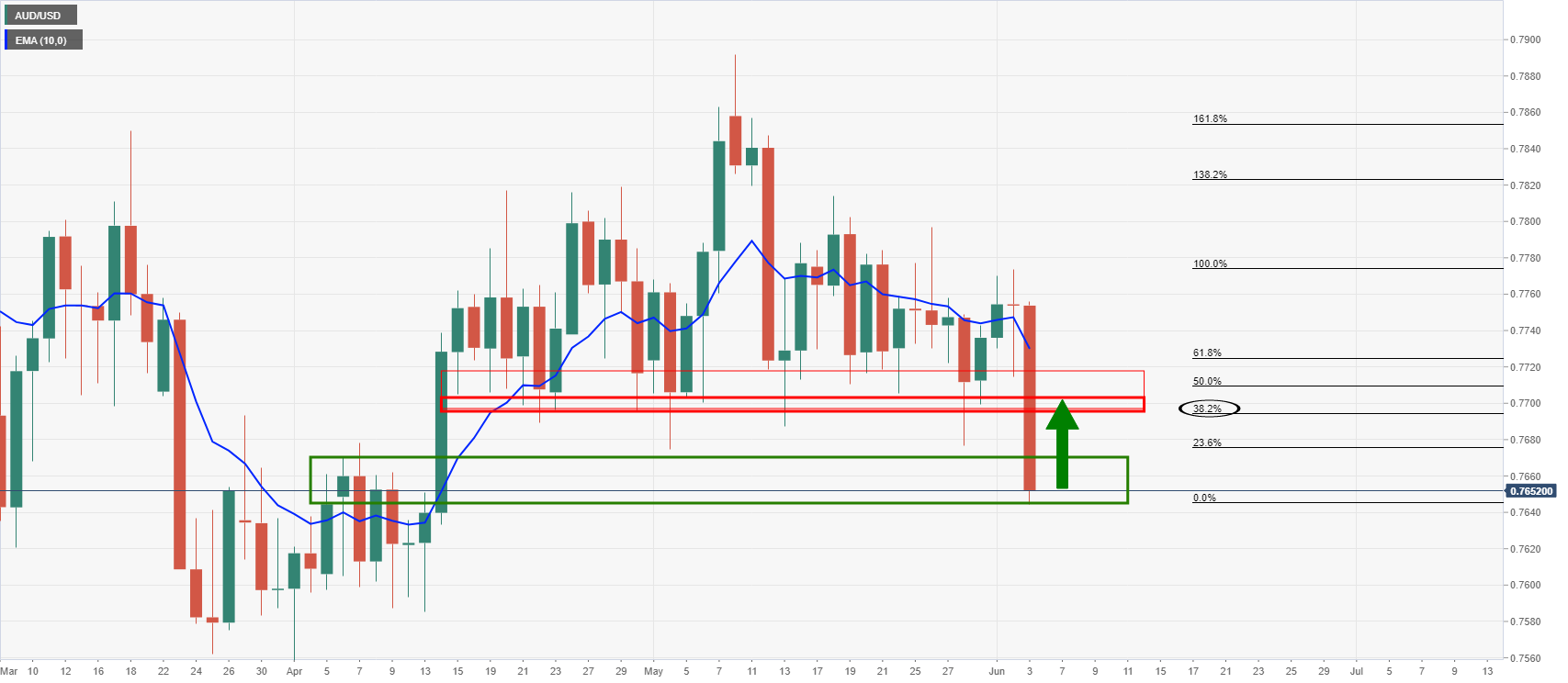

Live market analysis

As illustrated here and forecasted previously, the price has indeed melted into the support structure and would now be expected to correct to test the prior lows as a new area of resistance.

A 38.2% Fibonacci retracement has a perfect confluence with the resistance area.

Weekly bearish double-top

Meanwhile, from at least a medium-term perspective, the bulls are living dangerously buying into what is bearish double top structure and a price that is trending lower towards weekly support.