Back

4 May 2021

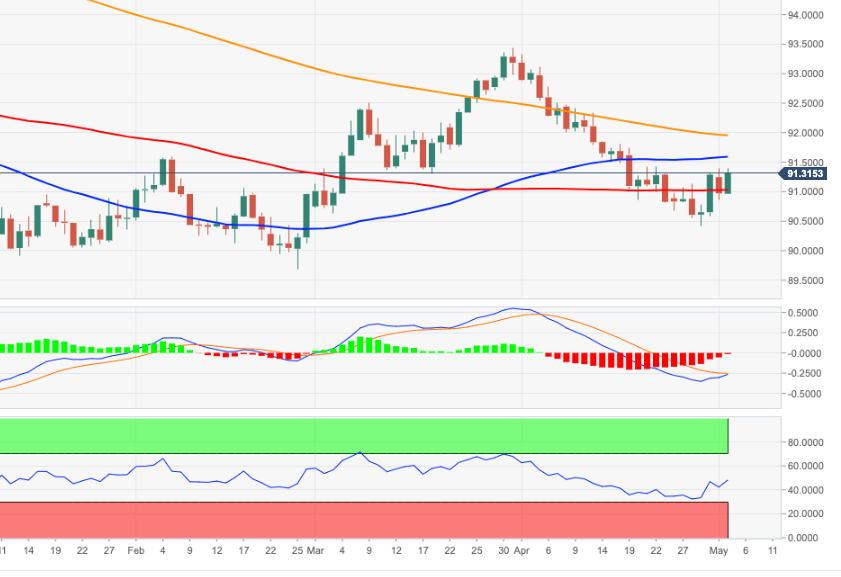

US Dollar Index Price Analysis: Next key target is at the 200-day SMA

- DXY resumes the upside above the 91.00 yardstick.

- There is an interim hurdle at the 50-day SMA near 91.70.

DXY fades Monday’s downtick and regains the upper hand amidst better sentiment around the buck.

Further recovery looks likely in the near-term. That said, if the interim resistance at the 50-day SMA near 91.70 is cleared, it should open the door to another visit to the critical 200-day SMA, today at 91.95.

Above the latter the downside pressure is expected to mitigate somewhat, and the outlook could start shifting to a more constructive one.

DXY daily chart