Silver Price Analysis: XAG/USD looks to retest key $25.00 resistance

- XAG/USD is consolidating near the $24.80 level.

- Additional gains are likely if XAG/USD manages to break above $25.00.

- Positive MACD hints at bullish bias.

The XAG/USD pair is hovering near the $24.80 level in the Asian session. The prices show some resilience near the daily lows of around $24.65.

At the time of writing, XAG/USD is trading at $24.84, up 0.08% on the day.

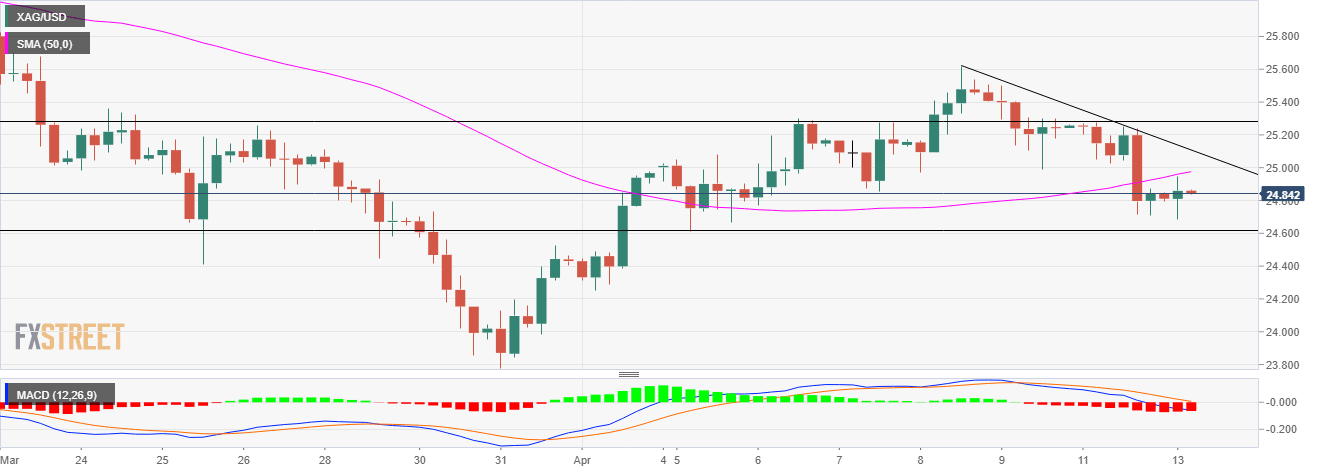

Silver four-hourly chart

On the four-hourly chart, the 50-hour simple moving average (SMA) continues to act as a dynamic resistance at $25.00, which coincides with the downward sloping line.

A sustained break above the $25.00 area would call for a test of the first hurdle near the $25.25 horizontal resistance zone. The white metal could then target Thursday’s high near the $25.60 region.

Further up, the next barrier is located at the highs of March 22 near the $25.80 neighborhood.

The Moving Average Convergence Divergence (MACD) indicator reads above the midline, with the bullish crossover reinforcing the upside bias.

On the flip side, If prices break below the support confluence near $24.60 then it would test the lows of April 1 near $24.30. Bears would ask for the level around $24.00 horizontal support area and the next level of monthly lows of $23.75.