GBP/JPY Price Analysis: Bears seek confirmation below 151.00

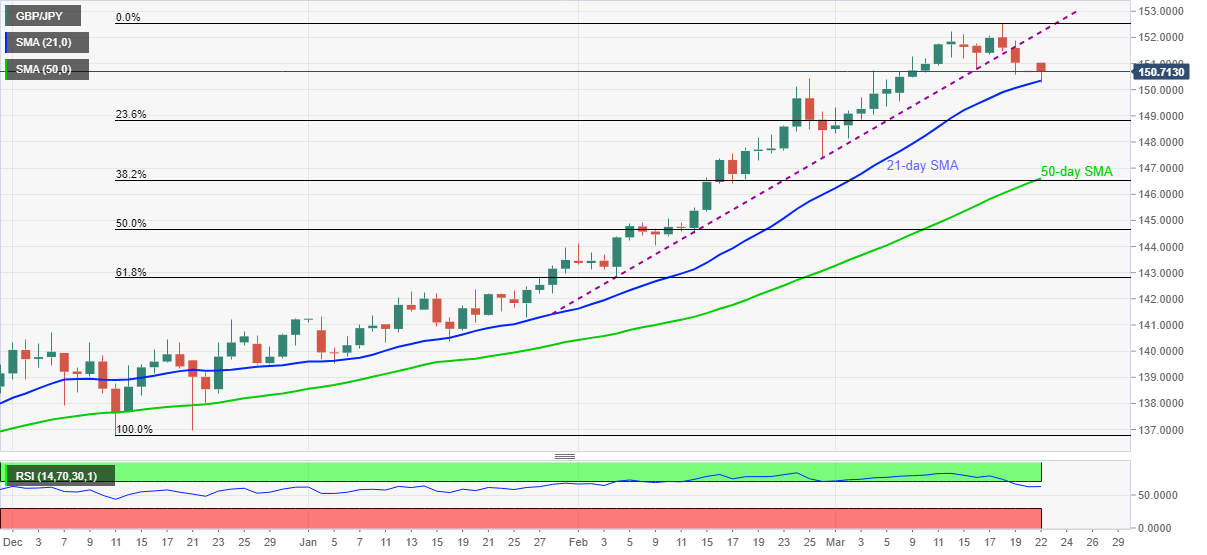

- GBP/JPY extends the previous week’s trend line breakdown but 21-day SMA tests bears.

- RSI pullback from overbought conditions favor sellers, bulls need to refresh monthly top to retake controls.

GBP/JPY eases from intraday top to 150.68 while fading recovery moves, which tried to fill the gap-down at the weekly open, amid early Asian session on Monday. In doing so, the quote keeps Friday’s downside break of an ascending support line from February 04.

Not only the sustained break of the previous key support line but RSI pullback from the overbought area also suggests the GBP/JPY weakness.

However, a daily closing below 21-day SMA, currently around 150.30, becomes necessary for GBP/JPY bears to eye the monthly low near 148.10.

Though, any further weakness past-148.10 will find it difficult as 50-day SMA and 38.2% Fibonacci retracement of 2021 upside will challenge GBP/JPY sellers around 146.60-50.

On the flip side, a corrective pullback can eye 151.00, 151.30 and the 152.00 round-figure before eyeing to refresh the multi-month top marked last week, around 152.55.

To sum-up, GBP/JPY prepares for a notable downside after the bulls tired during last week.

GBP/JPY daily chart

Trend: Further weakness expected