Gold Price Analysis: XAU/USD eyes $1921 upside level amid softer USD, vaccine hopes – Confluence Detector

Gold (XAU/USD) edges higher starting out a fresh week, challenging the $1900 hurdle amid a broadly softer US dollar. Coronavirus vaccine optimism and the Asia-pacific trade deal (RCEP) offset concerns over rising cases globally and boost the appetite for the riskier assets at the expense of the safe-haven greenback.

The vaccine euphoria is back in play this Monday, although the second virus wave worries continue to linger amid a light data docket. Let’s take a look at how gold is positioned technically.

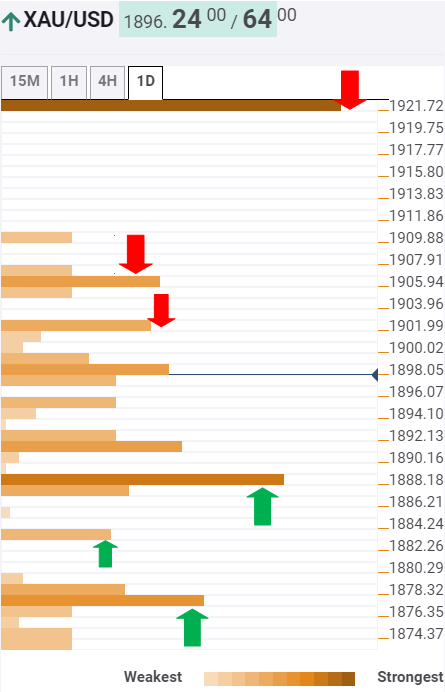

Gold: Key resistances and supports

The Technical Confluences Indicator shows that XAU/USD bulls are flirting with $1900, which is the SMA200 on four-hour.

The next resistance in sight remains the $1906 level, where the Fibonacci 61.8% one-month lies.

A sharp rally could be in the offing following a break above the latter, with a test of the critical $1921 barrier inevitable. That level is the convergence of the Fibonacci 61.8% one-week, pivot point one-day R3 and pivot point one-month R1.

On the flip side, a strong cap awaits at $1888, the intersection of the SMA5 four-hour, Fibonacci 38.2% one-day and one-month.

Acceptance below the latter could expose the next minor support at $1883, where the Fibonacci 61.8% one-day and SMA10 four-hour coincide.

Further south, the confluence of the SMA100 one-hour and Fibonacci 23.6% one-month at $1878 could challenge the bears’ commitment.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence