Back

28 May 2020

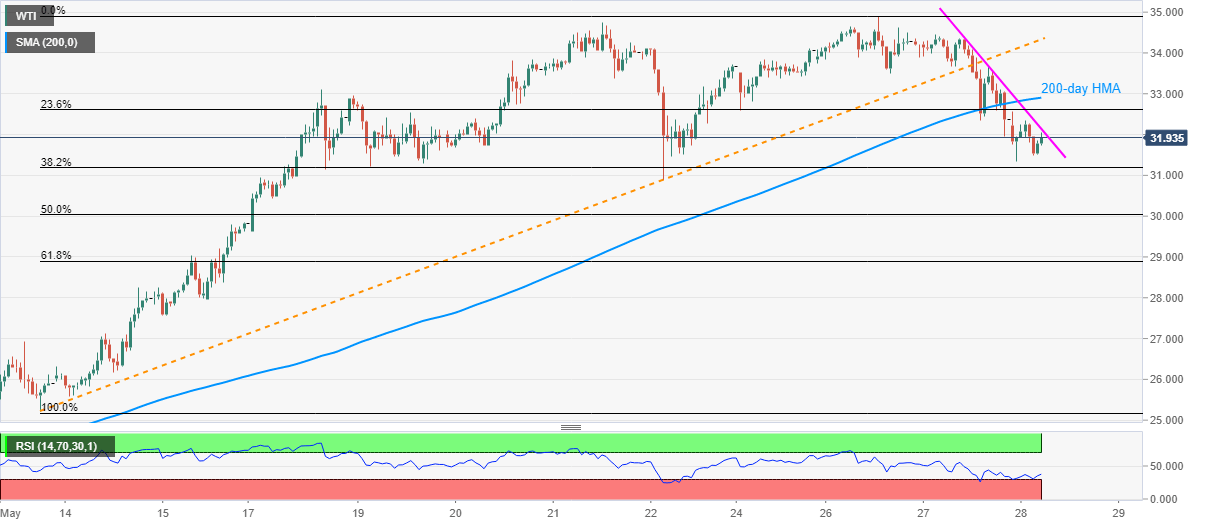

WTI Price Analysis: Bears can ignore latest bounces toward $32.00

- WTI’s pullback from $31.49 still left to cross near-term key resistances.

- The immediate falling trend line, 200-HMA acts as nearby upside barriers.

- Friday’s low, $30.00 on the bears’ radar during further declines.

WTI’s recovery moves from $31.49, fades momentum as the black gold trades around $31.92, down -1.39% on a day, ahead of the European open on Thursday.

The energy benchmark’s sustained break of the 11-day-old rising trend line, as well as 200-HMA, keeps the bears’ hopeful.

Also tightening the sellers’ grip could be immediate falling trend line connecting highs marked from Wednesday.

As a result, the pair’s further downside towards Friday’s low of $30.88 and then to $30.00 becomes much anticipated.

On the other side, an upside clearance of nearby resistance line, at $32.15, needs to overcome a 200-HMA level of $32.90 and the support-turned-resistance line of $34.30 to restore buyers’ confidence.

WTI hourly chart

Trend: Further downside expected