Back

15 May 2020

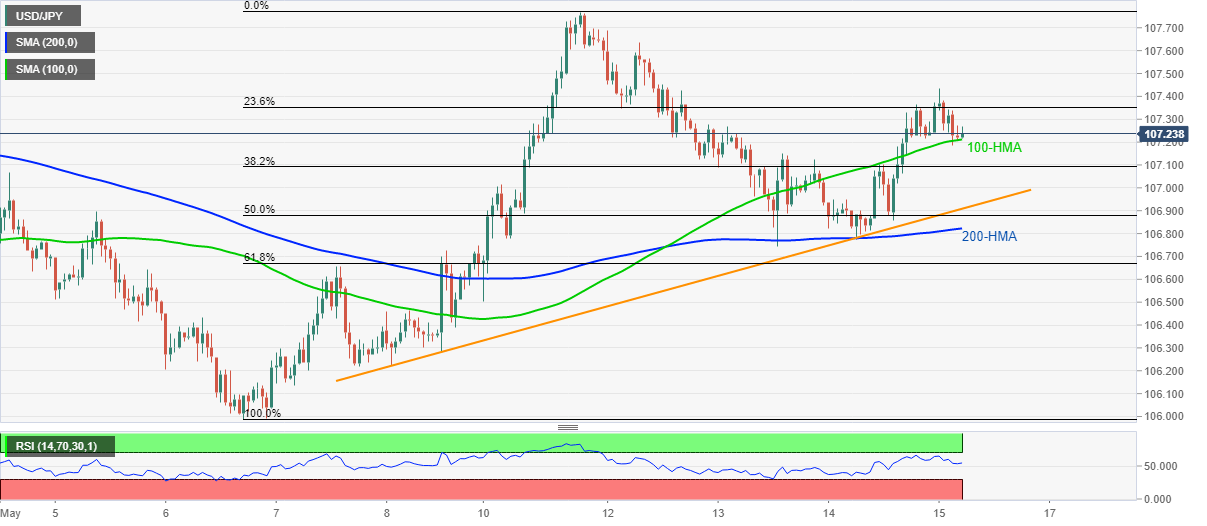

USD/JPY Price Analysis: Rests on 100-HMA above 107.00 amid quiet markets

- USD/JPY consolidates pullback form the three-day top, stays above 107.00.

- The one-week-old ascending trend line, 200-HMA adds to the supports.

- The monthly top can lure buyers during fresh upside.

USD/JPY trades near 107.24 as it enters Friday’s European session. The pair recently pulled back from Tuesday’s top but stays above 100-HMA off-late.

Considering the downward sloping RSI, sellers await a clear break of 107.20, comprising 100-HMA, to aim for the weekly support line, at 106.90.

Though, pair’s further declines depend upon how well the bears can dominate below 200-HMA level of 106.80.

Meanwhile, an upside clearance of the recent high, 107.43, can propel the pair towards the monthly peak of 107.77. However, multiple resistances marked during the mid-April around 108.05/10 can keep the bulls chained afterward.

USD/JPY hourly chart

Trend: Sideways