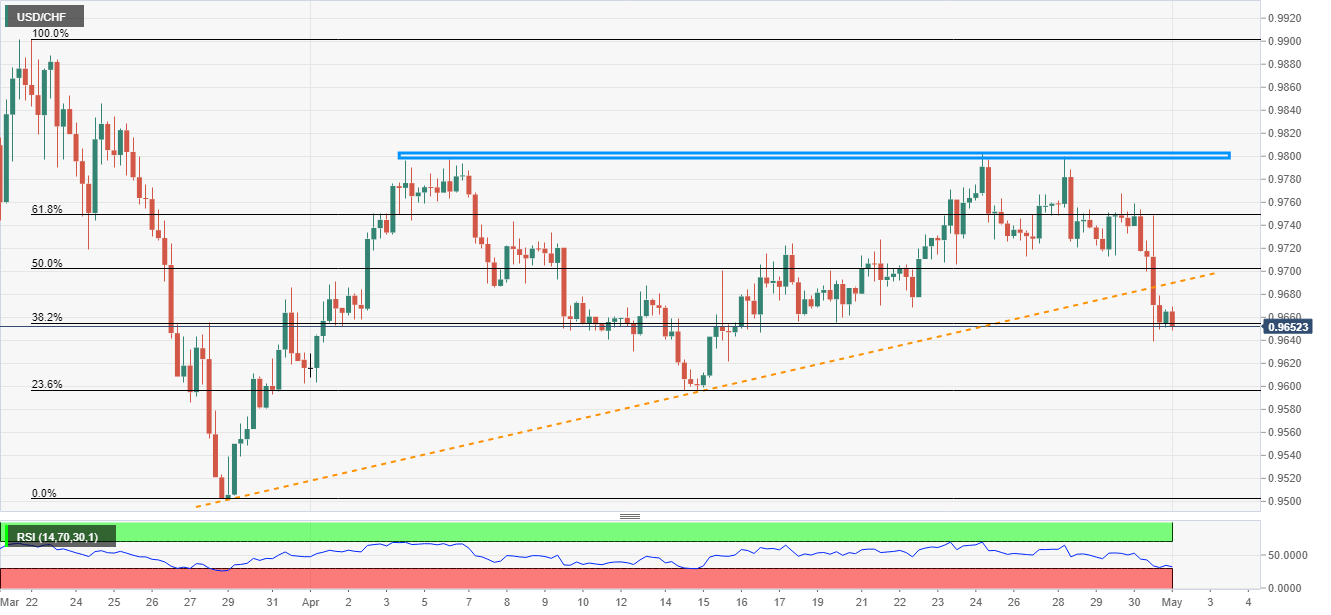

USD/CHF Price Analysis: Oversold RSI check sellers below 0.9700

- USD/CHF pauses after four-day declines.

- Sustained trading below a five-week-old trend line keeps sellers hopeful.

- April 24 high becomes the key upside barrier.

USD/CHF extends fall below multi-day rising trend line while flashing 0.9653 as a quote during the early Friday. Even so, 38.2% Fibonacci retracement of March month fall restricts the pair’s immediate downside amid oversold RSI conditions.

As a result, USD/CHF prices can bounce to the support-turned-resistance line around 0.9690. However, further upside depends upon how well the buyers dominate past-50% Fibonacci retracement level of 0.9700.

Even in that case, 61.8% Fibonacci retracement, near 0.9750, as well may multiple tops since April 06 just around 0.9800 will keep the bulls in check.

On the downside, a sustained break below 0.9650 immediate support can aim for mid-April bottom surrounding 0.9595/90 as well as 0.9580 ahead of targeting March month low near 0.9500.

USD/CHF four-hour chart

Trend: Pullback expected