USD/JPY: Stuck on familiar ground, bulls can't catch a break through 108

- USD/JPY holding in familiar territory, yen remains robust.

- Risk-on and risk-off ebbs and flows see USD/JPY stable.

- Terrible data underpinning an underbelly of risk-off.

USD/JPY has opened in Tokyo around familiar levels, currently trading at 107.68 having moved in a right spot between 107.55 and 107.70. The risk-off tone dominates with US stocks unable to break from the restraints of COVId-19 implications for the global economy and the Nikkei has opened over 0.5% lower and 108 handle is falling over the horizon.

- Wall Street Close: Still no cure in sight for COVID-19, extinguishes optimism

USD/JPY was volatile overnight, with a bid on the report that the BoJ next week would discuss unlimited bond-buying, replacing the current JPY80 trillion annual target, although bulls were unable to capitalise through the 108 psychological figure.

Nonetheless, according to Nikkei News, the doubling purchases of commercial paper and corporate bonds will also be pondered. Also, Japan's cases of COVID-19 have risen sharply over the last several weeks but the yen will likely find support from safe-haven flows due to the nation's surplus status, capping rallies.

Meanwhile, data from overnight showed dismal and worst than feard PMIS. The collapse in Eurozone April PMIs was even more dramatic than forecast and still EU leaders ere unable to agree on a rescue package. More on that here: Talks between EU leaders' end with no agreement on the recovery package, EUR/USD drops

As for the PMIs

EU PMI:

- EZ Services plunged to a staggering 11.7 from 26.4 in March and 52.6 in February.

- The Eurozone manufacturing index tumbled from 44.5 to 33.6.

- Markit’s pessimistic write-up warned of a secondary wave of COVID infections and a contraction of around -7.5% of EZ GDP.

UK PMI:

- The UK composite PMI tumbled to 12.9 from 36.0. Services fell to 12.3 from 34.5 and manufacturing dropped to 32.9 from 47.8.

- Around 81% of UK service providers and 75% of manufacturing firms reported a fall in business activity.

- On April 5 the ONS estimated that 27% of the UK workforce has been furloughed and roughly 25% of businesses had ceased trading.

US PMI:

- US Composite PMI fell to 27.4 from 40.9. Services fell to 27.0 from 39.8 and manufacturing fell to 36.9 from 48.5.

A sea of red

In other US data, the US initial jobless claims climbed 4.4 million in the week to 18 April, close to estimates. this brings a five-week total to 26.5m. Continuing claims as at 11 April totalled 16.0 million. The US Kansas Fed manufacturing survey dropped to -30 from previous -17 while March New Home Sales dropped 15.4%.

Latest data from Japan

- Japan PPI services (YoY) Mar: 1.6% (est 1.7%; prev 2.1%).

-

Japanese CPI: Rising 0.4 percent in line with estimates

COVID-19 updates

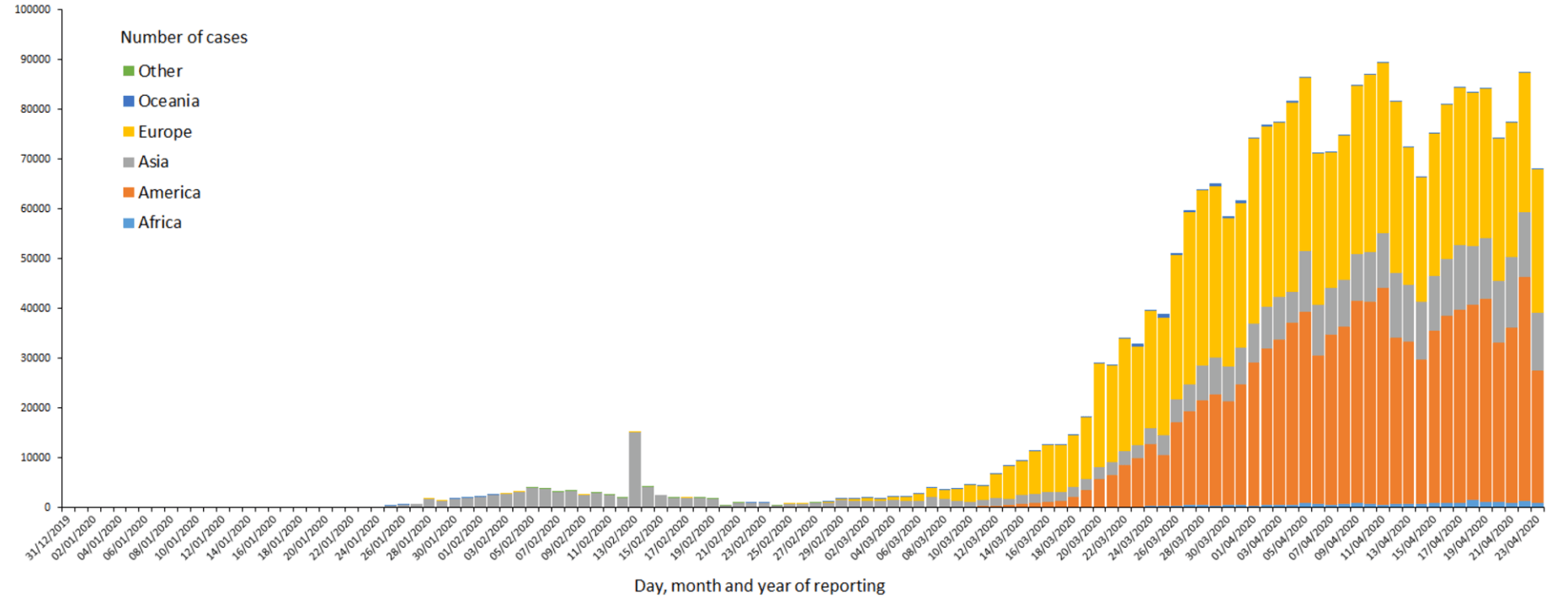

New cases have only risen 2.5% which is the slowest rate this month. Overnight, according to the European Centre for Disease Prevention and Control, since 31 December 2019 and as of 23 April 2020, 2 588 068 cases of COVID-19 (in accordance with the applied case definitions and testing strategies in the affected countries) have been reported, including 182 808 deaths.

For a break down of US and Japanese COVID-19 cases and subsequent USD & JPY positioning, see here: USD/JPY faded through the 108 level, a reoccurring theme

USD/JPY levels and forecast

-

USD/JPY Forecast: BOJ said to analyse unlimited QE