EUR/USD Technical Analysis: Below 8-week-old support trendline after a speech by Fed’s Powell

- EUR/USD seesaws around eight-day low after Fed’s Powell gave no strong monetary policy cllues.

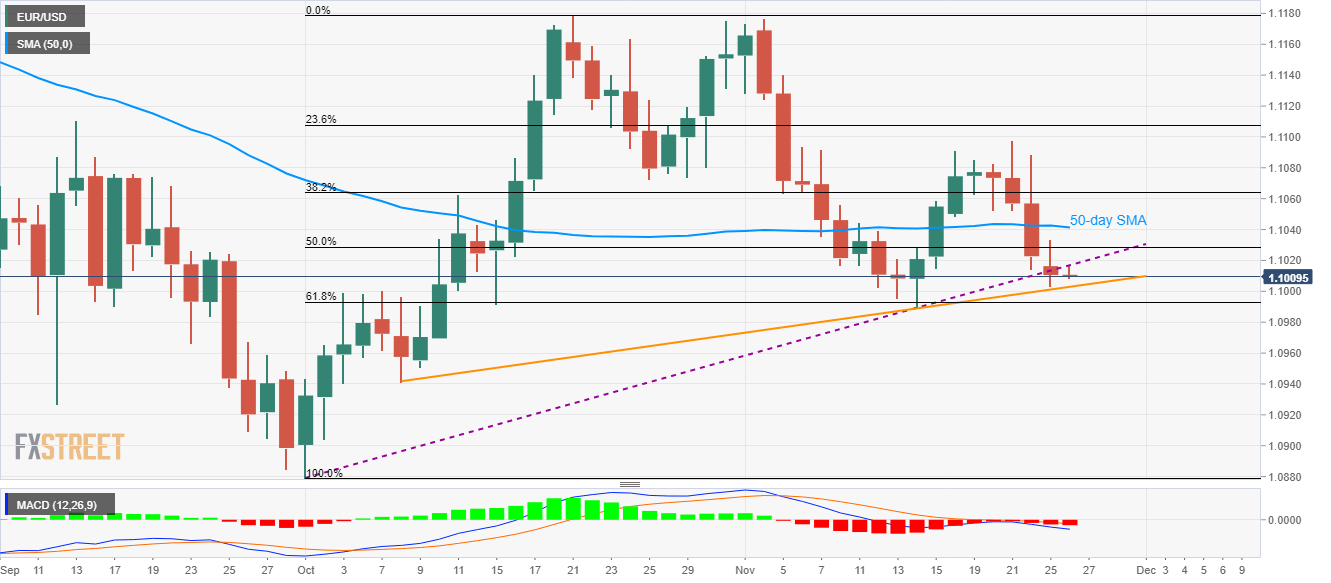

- Sustained trading below multi-week-old support line drags the quote to another trend line support.

- 61.8% Fibonacci retracement adds to the support.

EUR/USD remains on the back foot while taking rounds to 1.1010 during the Asian session on Tuesday.

The United States (US) Federal Reserve (Fed) Chairman Jerome Powell refrained from any significant policy clues while speaking at the Providence Chamber of Commerce Annual Meeting in Rhode Island.

Read: Fed's Powell: Fed will respond accordingly

The pair extends the downpour after breaking an eight-week-old trend line the previous-day, now at 1.0017, which in turn increases the odds of its drop to another support line stretched since October 08 that lies around 1.0000 psychological magnet.

Also providing the support is 61.8% Fibonacci retracement of October month run-up at 1.0993 and the monthly bottom near 1.0990.

Meanwhile, pair’s upswing beyond the support-turned-resistance line of 1.0017 can trigger fresh pullback to the 50-day Simple Moving Average (SMA) level of 1.1041. However, last week’s top near 1.1100 could question buyers afterward.

EUR/USD daily chart

Trend: Bearish