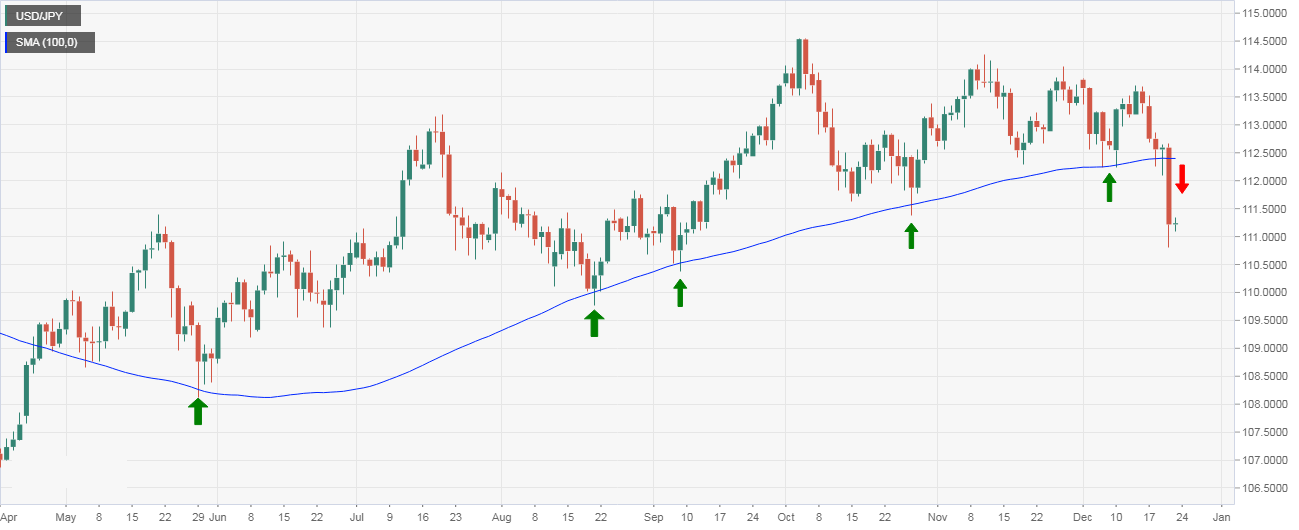

USD/JPY Technical Analysis: Bull-to-bear trend change confirmed

- The USD/JPY pair closed well below the crucial 100-day moving average (MA) support, confirming a bullish-to-bearish trend change.

- The long-term average had caught lows on a closing basis in May, August, September, and October. The average also worked as strong support earlier this month.

- The bears, therefore, could be feeling emboldened, having breached the 100-day MA. Simply put, the break below the key average marks an end of the rally from the March low of 104.63.

- The pair could soon explore levels below the psychological support of 110.00. The bearish outlook would be invalidated if and when the 100-day MA hurdle is scaled.

Daily Chart

Trend: Bearish

USD/JPY

Overview:

Today Last Price: 111.25

Today Daily change: 3.0 pips

Today Daily change %: 0.0270%

Today Daily Open: 111.22

Trends:

Previous Daily SMA20: 113.09

Previous Daily SMA50: 112.97

Previous Daily SMA100: 112.4

Previous Daily SMA200: 110.88

Levels:

Previous Daily High: 112.67

Previous Daily Low: 110.81

Previous Weekly High: 113.71

Previous Weekly Low: 112.24

Previous Monthly High: 114.25

Previous Monthly Low: 112.3

Previous Daily Fibonacci 38.2%: 111.52

Previous Daily Fibonacci 61.8%: 111.96

Previous Daily Pivot Point S1: 110.46

Previous Daily Pivot Point S2: 109.71

Previous Daily Pivot Point S3: 108.6

Previous Daily Pivot Point R1: 112.32

Previous Daily Pivot Point R2: 113.43

Previous Daily Pivot Point R3: 114.18