Back

2 Nov 2018

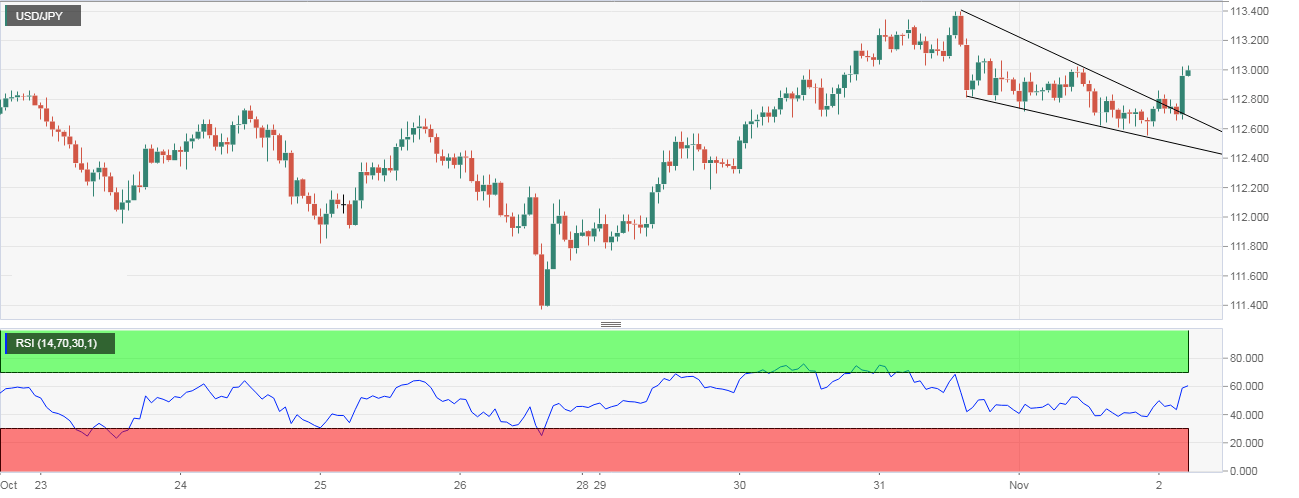

USD/JPY Technical Analysis: Talk of US-China trade deal triggers falling wedge breakout

- Bloomberg is reporting that President Trump has asked the cabinet to draft a possible trade deal with China. The news comes after Trump and Xi's telephonic conversation ahead of the G-20 Summit.

- The news is helping the CNY, risk currencies and most majors score gains against the US dollar. The anti-risk Japanese yen, however, is on the defensive against the greenback. The price action in the FX markets is indicative of a solid risk-on action during the day ahead.

- The USD/JPY witnessed a falling wedge breakout a few minutes before press time and is currently trading at 113.00. The pattern indicates a resumption of the rally from the Oct. 26 low of 111.38 and could yield re-test of the recent high of $113.38.

- The RSI on the hourly chart has also turned bullish above 50.00.

Hourly Chart

Trend: Bullish

USD/JPY

Overview:

Last Price: 112.73

Daily change: 2.0 pips

Daily change: 0.0177%

Daily Open: 112.71

Trends:

Daily SMA20: 112.55

Daily SMA50: 112.3

Daily SMA100: 111.67

Daily SMA200: 109.91

Levels:

Daily High: 113.06

Daily Low: 112.6

Weekly High: 112.9

Weekly Low: 111.38

Monthly High: 114.56

Monthly Low: 111.38

Daily Fibonacci 38.2%: 112.77

Daily Fibonacci 61.8%: 112.88

Daily Pivot Point S1: 112.52

Daily Pivot Point S2: 112.32

Daily Pivot Point S3: 112.05

Daily Pivot Point R1: 112.98

Daily Pivot Point R2: 113.26

Daily Pivot Point R3: 113.45