Back

24 Jul 2017

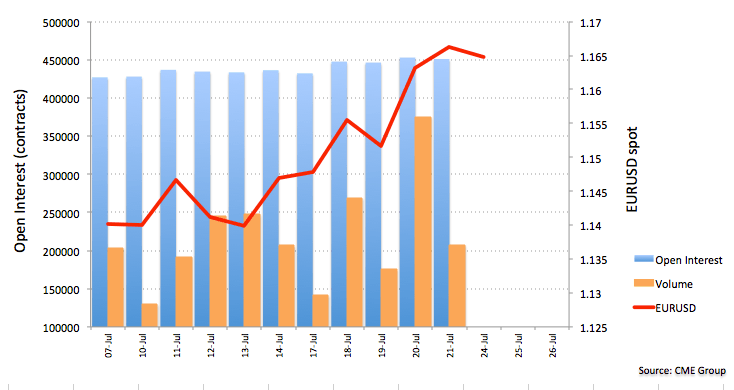

EUR futures: markets still wait for a correction

CME Group’s preliminary data for Friday showed open interest decreased by more than 2K contracts from Thursday’s 452,997 contracts (monthly high). Volume followed suit, dropping by over 167K contracts.

EUR/USD: correction lower on the cards

Friday’s test of 2-year tops in the 1.1680/85 band and the subsequent pullback seems to have opened the door for a long-waited correction lower. The decrease in open interest plus the significant drop in volume supports that scenario in the very near term. Occasional drops, however, should prompt dip-buyers to step into the market, as the underlying sentiment around the European currency still is clearly bullish.