US Dollar tumbles further on Trump jitters

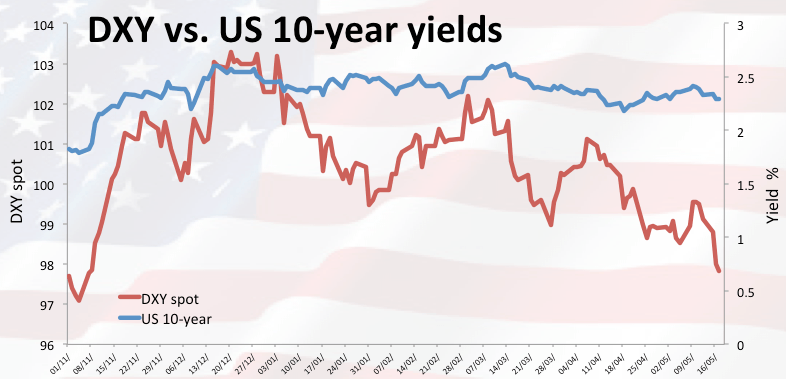

The greenback – tracked by the US Dollar Index (DXY) – continues to give ground on Wednesday, breaking below 97.80 amidst Trump woes.

US Dollar in 6-month lows

The index has retreated to levels last seen in early November, fully retracing the post-US elections rally and trading in red figures for the fifth session in a row.

The Trump-FBI dispute brought in fresh USD-sellers and dragged the index further south of the key support at 98.00 the figure, prompting market participants to wonder whether a fresh bearish trend has just emerged around the buck.

In the meantime, the likeliness of further tightening by the Federal Reserve at its June meeting seems to have been eclipsed so far by headlines involving President Trump and the possibility of his impeachment, all against the backdrop of declining US yields and the continuation of the sell off in USD.

On the data front, the usual weekly report of the DoE on US crude oil inventories is only due later today.

US Dollar relevant level

The index is losing 0.29% at 97.82 and a break below 96.94 (low Nov.4 2016) would open the door to 95.91 (low Nov.9 2016) and then 94.95 (low Sep.22 2016). On the upside, the next hurdle lines up at 98.96 (20-day sma) ahead of 99.20 (200-day sma/12-month resistance line) and finally 99.77 (high May 11).