NZD/USD stays in daily channel despite market volatility

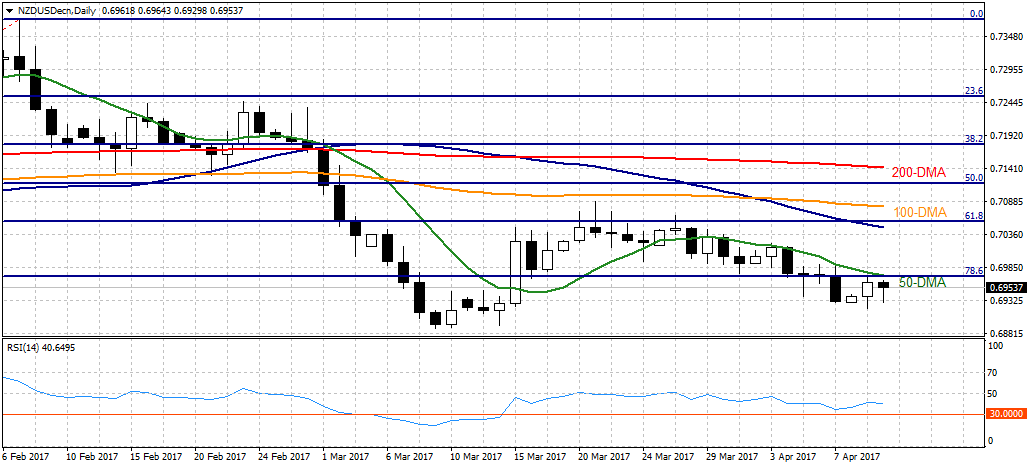

Although the market volatility increased during the NA session, the NZD/USD pair remained in a narrow band on Tuesday. As of writing, the pair is down 0.13% at 0.6953, having posted a daily high at 0.6966 and low at 0.6930.

The pair couldn't take advantage of the weak greenback owing to a flight to safety amid geopolitical concerns. The recent headlines are suggesting that the U.S. could continue to make additional strikes on Syria keep the investors on edge.

There are no fundamental data due to be released from New Zealand during the Asian session. However, Consumer Price Index from China could provide the pair with some needed fresh impetus. Since the pair moved below 0.70, it has been moving in a 50 pip channel, unable to determine the next short-term direction. Additionally, Westpac Consumer Confidence index from Australia could run the AUD/USD pair and help the NZD make a decisive move as it's highly correlated with the AUD.

Technical levels to consider

The pair faces the immediate resistance at 0.7000 (psychological level) followed by 0.7080 (100-DMA) and 0.7140 (200-DMA). To the downside, suıpports could be found at 0.6930 (daily low) before 0.6890 (Mar. 9 low) and 0.6800 (psychological level).