Back

9 Aug 2023

Crude Oil Futures: Rally appears exhausted

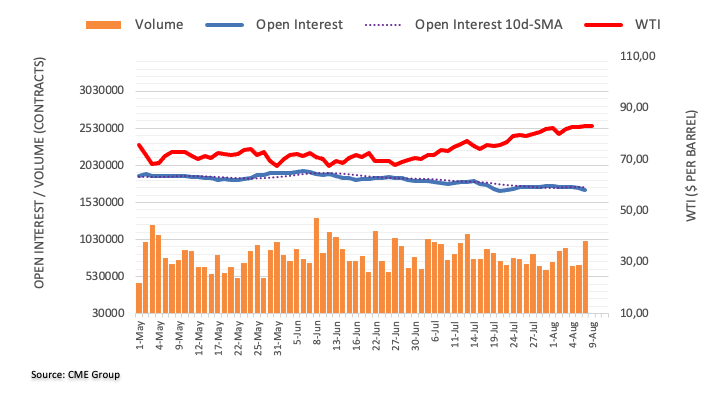

Considering advanced prints from CME Group for crude oil futures markets, open interest shrank for the third session in a row on Tuesday, now by around 21.8K contracts. On the other hand, volume went up for the second straight session, this time by 321.1K contracts.

WTI seems to have met resistance around $83.00

WTI prices charted a volatile session on Tuesday, briefly visiting the key $80.00 mark before ending the session with decent gains near $83.00. The uptick was amidst diminishing open interest and leaves the commodity vulnerable to an impasse in the current rally in the very near term. So far, the 2023 highs past $83.00 still emerges as the immediate target for the time being.