Natural Gas: Decent support emerges around $2.50

Prices of the MMBtu of natural gas keeps the inconclusive price action around the $2.60 region on Tuesday, or the lower end of the weekly range, following the strong pullback recorded at the beginning of the week.

Indeed, and after hitting multi-week peaks just above the key $3.00 mark on March 3, prices of the commodity resumed the downtrend in response to reports that confirmed that a milder weather lies ahead, which in turn undermined the expected outlook for heating demand.

As observed from the futures markets tracked by CME Group, natural gas prices could have carved a near-term top around the key $3.00 mark per MMBtu (March 3).

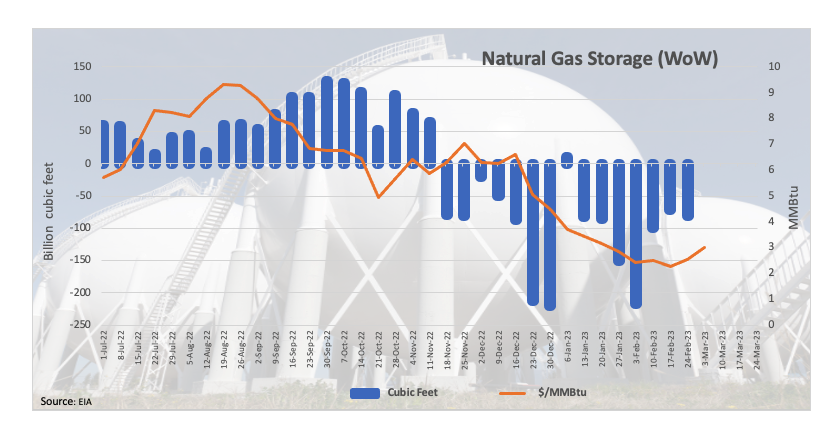

Later in the week, the EIA will publish its usual report on natural gas storage for the week ended on March 3 (Thursday).

Natural Gas levels to watch

At the moment, Natural Gas prices are advancing 1.40% at $2.608 and faces the next up-barrier at $3.009 (monthly high March 3) seconded by $3.182 (Fibo retracement) and finally $3.410 (55-day SMA). On the downside, a break below $1.967 (2023 low February 22) would expose $1.795 (monthly low September 21 2020) and then $1.605 (monthly low July 20 2020).