Back

22 Feb 2023

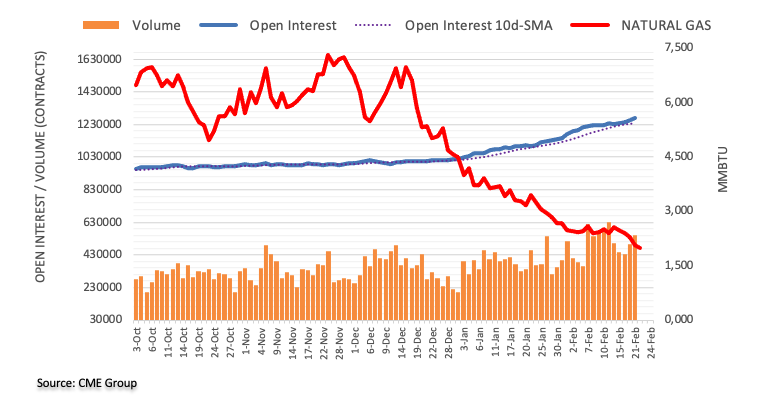

Natural Gas Futures: Downside has further legs to go

Open interest in natural gas futures markets extended the uptrend for yet another session on Tuesday, this time increasing by around 15.4K contracts according to preliminary readings from CME Group. Volume, too, added to the previous daily build and went up by around 56.3K contracts.

Natural Gas risks a drop to $1.80

There seems to be no respite for the decline in prices of the natural gas, which put the key $2.00 mark per MMBtu to the test for the first time since September 2020 on Tuesday. The downtick was on the back of rising open interest and volume and still underpins the idea of further weakness in the near term. Against that, the September 2020 low near $1.80 now emerges as the next support of relevance.