Back

21 Nov 2022

Crude Oil Futures: Short-term rebound looks likely

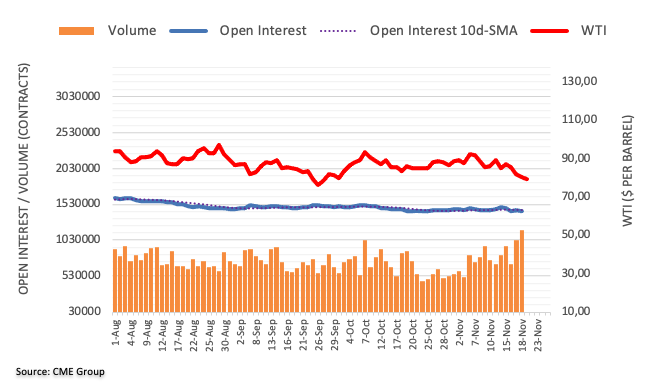

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions by nearly 12K contracts on Friday, partially reversing the previous build. Volume, instead, rose for the second day in a row, this time by more than 133K contracts.

WTI: The September low near $76.00 comes next

Prices of the WTI remained under pressure on Friday and closed the third consecutive session with losses. The leg lower, however, came amidst shrinking open interest and another daily build in volume. That said, while a short-term rebound seems probable in the very near term, there is also scope for the continuation of the underlying downtrend with the immediate support at the September low near the $76.00 mark per barrel.