How does Forex differ from other markets?

Expand your knowledge about Forex

The foreign exchange (Forex) market is the largest financial market in the world. It has a total daily average volume of 7.5 trillion USD. Trying to get an idea about what Forex is and how you can trade this volatile market? In this article, we'll get to the basics of trading and learn some key terms that will help you get started.

Forex, or Foreign Exchange (FX), is popularly known as an essential instrument for currency exchange worldwide. The vast marketplace is the centre of many different currencies that are traded daily to support global trade, tourism, and personal economic plans for profit. The market operates 24 hours a day, five days a week, and covers most financial centres, including New York, London, Tokyo, and Zurich. The Forex participants are banks, financial corporations, hedge funds, and individual traders. The market is universal and can be used for both speculation and hedging currency risks. A broker is a company that gives you access to the Forex market. You can start trading with them by registering on their website and opening a trading account. Normally, everything is done online. You can manage your accounts and open and close new orders from your mobile phone or computer. It's up to you.What is Forex?

Forex provides advanced opportunities for traders of different levels. These features make the market unique:How does Forex differ from other markets?

When it comes to Forex trading, each trade involves selling one currency and buying another at the same time, for example, GBPUSD. The first currency in the pair is the base currency, and the second is the quote currency.How to read Forex pairs?

1. GBP is called the base currency

2. USD is the quote currency

Forex pairs are classified as majors, minors, and exotic pairs. Major currency pairs Major pairs include USD as the base or quote currency. These pairs include USDJPY, USDCHF, USDCAD, EURUSD, NZDUSD, AUDUSD, and GBPUSD. Minor currency pairs or cross-currency pairs These currencies are derived from major pairs, i.e., they are cross pairs of major currencies. They include, among others, GBPCAD, EURJPY, and GBPCHF. Cross pairs are derived from the major pairs in the following way: GBPCAD example GBPCAD is derived from major pairs GBPUSD and USDCAD (GBP/USD)×(USD/CAD) (GBP/USD)×(USD/CAD)=GBPCAD EURCHF example (EUR/USD)×(USD/CHF) (EUR/USD)×(USD/CHF)=EURCHF Exotic currency pairs Exotic pairs consist of a major pair, either base or quote, traded against the currency of a developing country. Examples include USDMXN, USDHKD, and GBPZAR.Forex pairs explained

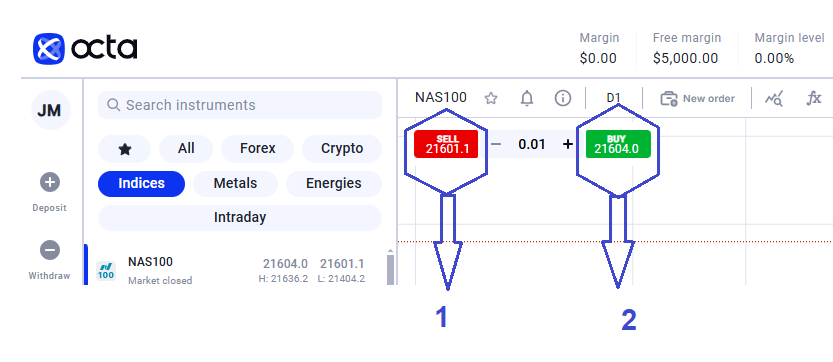

In Forex trading, 'bid' and 'ask' prices are defined as follows: 'bid' is the price you'll receive when you sell a currency, and 'ask' is the price you pay when you buy.Bid and ask prices in Forex

1. Bid

2. Ask

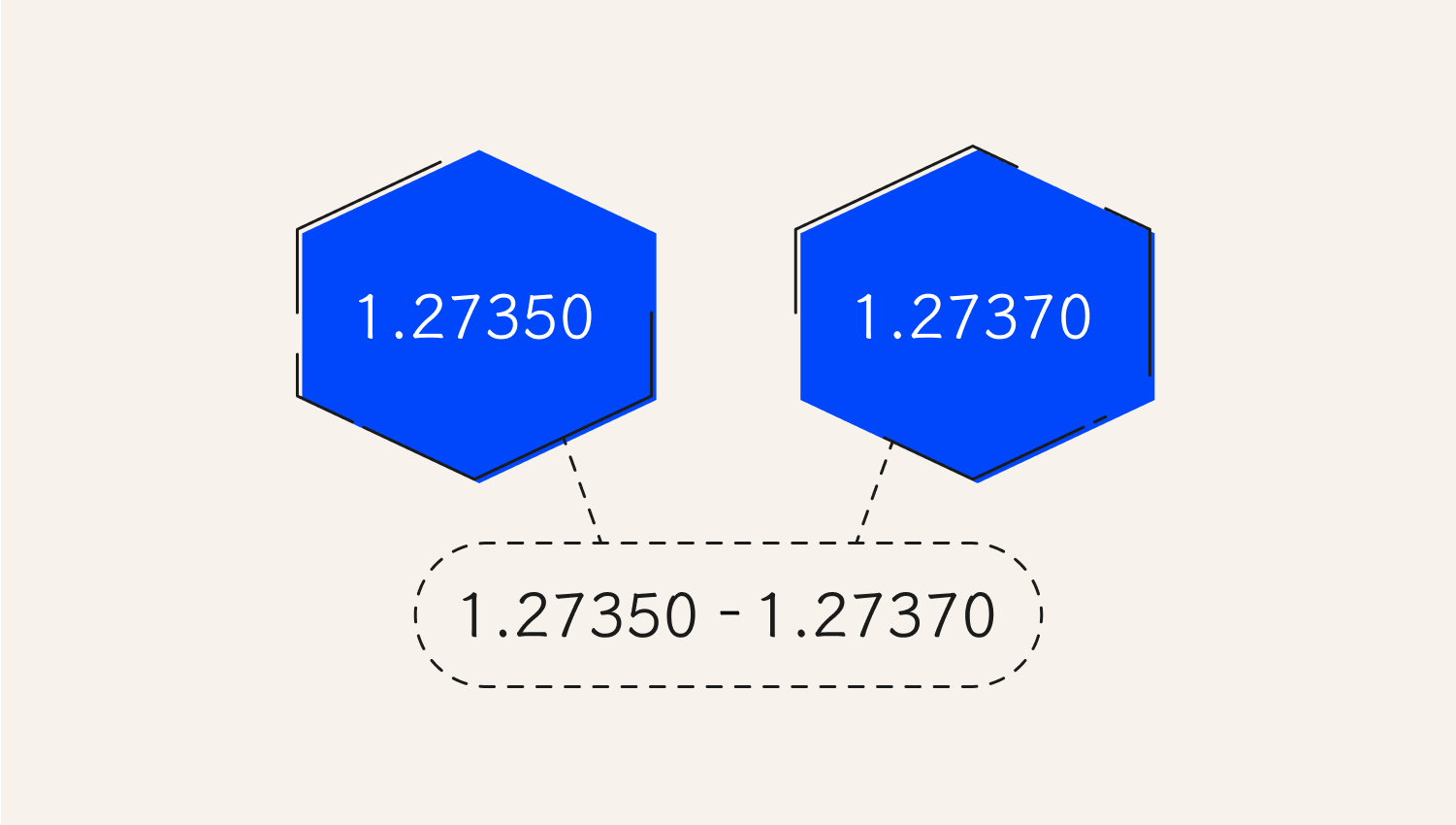

Spread is a key term in Forex trading. It represents the transaction cost. The spread is simply the difference between the buying and selling prices of currencies. This difference represents the commission your broker receives for handling your trade, thus determining the price of your markets.Spread in Forex trading

The difference is the spread. In the example above, the GBPUSD spread is 2 pips.

Forex is exciting! It's the world's largest financial market, so you can imagine its potential for investors. Since it became more accessible to users worldwide, it has become an alternative to earning a living for many people. If you are thinking about joining, Octa is here for you. Octa is an award-winning international broker. By choosing us as your Forex trading platform, you'll benefit from the following trading conditions, helping to make your experience a smooth and easy one: It's easy to get started: simply open an account on our website to register and create your profile. In your profile, you can: Set up your trading account and place your first trades. Inexperienced traders can join the Forex market just by following these four steps of successful trading.Why join a Forex broker

To profit from trading, you need to learn about the market, its features, and possible changes and risks. Use the following sources: You can also learn more about Forex in our article.Expand your knowledge about Forex

Final thoughts